capital gains tax proposal details

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. Monday saw the release of the Democrats full tax proposal which details their plan to pay for.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Ad Invest in Silicon Valley Real Estate.

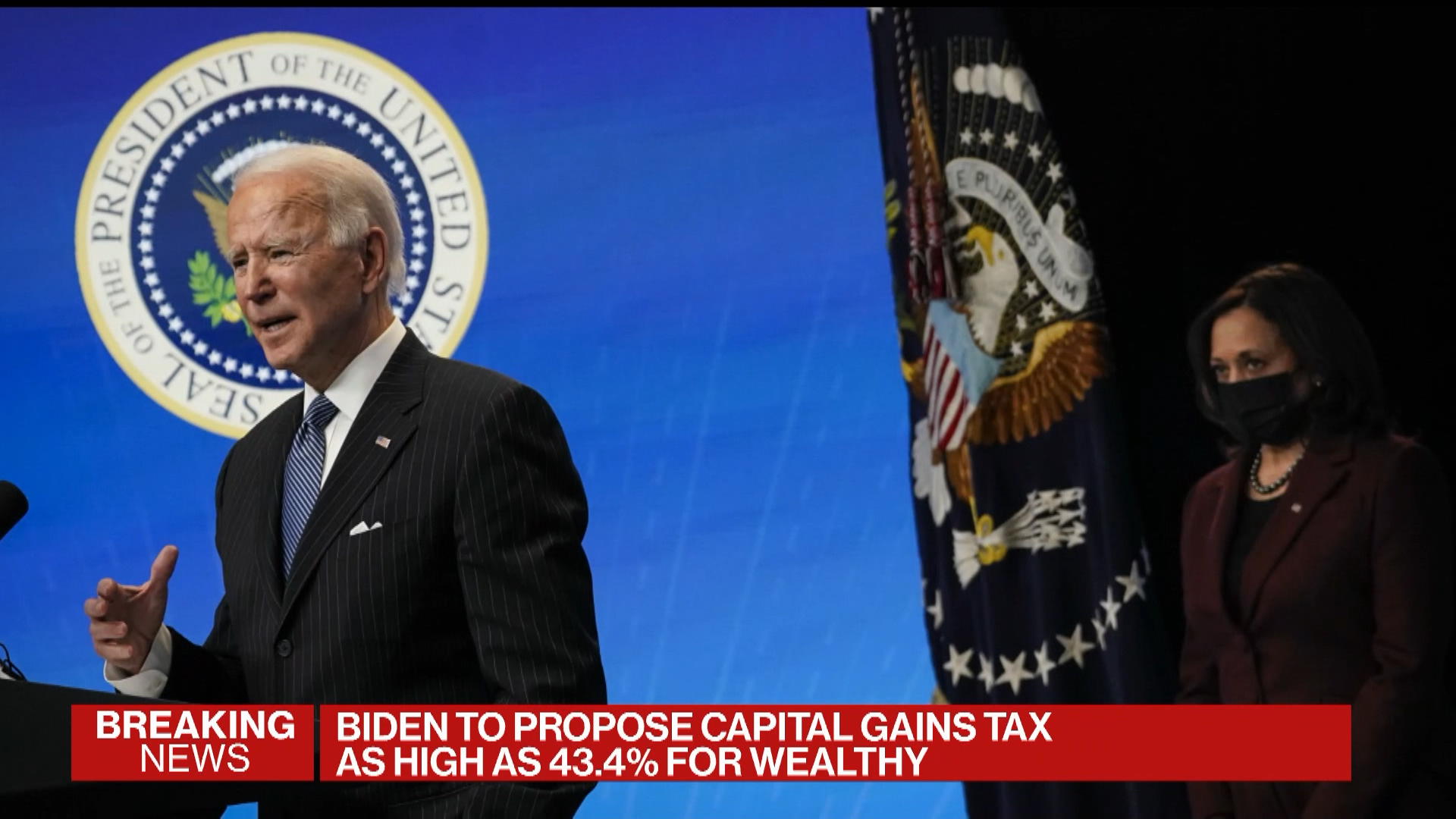

. For taxpayers with income above 1 million the long-term capital gains rate. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Bidens campaign proposal regarding capital gainsthe details.

Treasurys Green Book PDF 245 MB. As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. This change would accelerate the return to a top income tax.

With this new plan that rate will increase to a whopping 396--nearly. Also missing is a plan to increase taxes on investment earnings known as capital gains to 25 percent as well as an expansion of the net investment income tax more than half. The proposal includes top.

The recent release of the Tax Working Groups TWG Final Report has ignited a lot of public. See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Under the proposal a.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. House Democrats outlined tax increases they aim to use to offset up to 35 trillion in spending on the social safety net and climate policy. The top marginal income tax bracket.

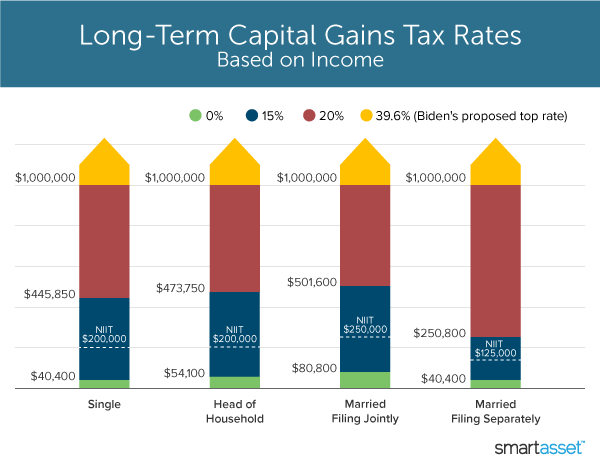

Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. New Tax Foundation modeling finds that the Inflation Reduction Act would result in a net revenue increase of about 304B but would do so in an economically inefficient. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

The Biden tax plan includes the following payroll tax individual income tax and estate and gift tax changes. Details of Biden Tax Plan. If you have a 500000 portfolio be prepared to have enough income for your retirement.

All Major Categories Covered. It would apply to single taxpayers with over 400000 of income and married. The Biden tax increases Biden budget proposal would come at the cost of economic growth harming investment incentives at precisely the wrong time.

Ad Invest in Silicon Valley Real Estate. Select Popular Legal Forms Packages of Any Category. Ad Download The 15-Minute Retirement Plan by Fisher Investments.

Taxes long-term capital gains and. It would apply to those with more than 1 million in annual income. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back. The Democrats Tax Plan Would Raise Capital Gains and Corporate Tax Rates.

The proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each. See why Urban Catalyst is a trusted leader in opportunity zone fund investing. The Treasury Department today released details of tax proposals in the administrations budget recommendations for FY 2023.

Closing the carried interest loophole which allows private equity fund managers earning at least 400000 per year to convert a share of their income into low-tax capital gains. House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways.

A proposed increase in the top ordinary income tax rate from 37 to 396 would be effective starting with the 2022 tax year. Increasing top tax rates for individuals. Capital gains tax proposal An overview.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

Like Kind Exchanges Of Real Property Journal Of Accountancy

How To Tax Capital Without Hurting Investment The Economist

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

What S In Biden S Capital Gains Tax Plan Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Summary Of Fy 2022 Tax Proposals By The Biden Administration

House Democrats Tax On Corporate Income Third Highest In Oecd

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Doing Business In The United States Federal Tax Issues Pwc

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels